Resource Exchange International, Inc. (REI) takes the matter of “Building People to Build a Nation” very seriously, mobilizing resources so that professionals in several countries can strengthen the strategic sectors of their country. In Indonesia we direct our attention toward those whose income prospects are limited. Specifically, we work among low-income families in rural villages, creating jobs that can equip them with skills and abilities they need to improve their lives.

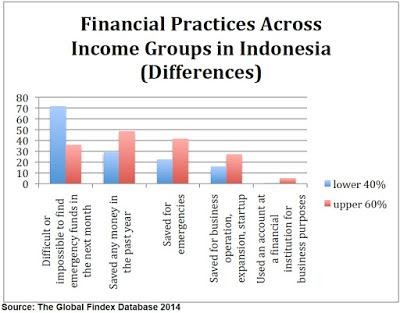

In order to grasp the economics of this group of low-income households, consider data about their financial saving and borrowing practices. Figure 1 below presents some stark contrasts between the group representing the lowest 40% of household income and the group representing the upper 60% of household income.

Note that saving practices are noticeably less frequent among low-income individuals, presenting a picture of financial vulnerability. In addition, over 70% of low-income respondents reported that it would be difficult or impossible to obtain funds in the event of an emergency. Low savings behavior combined with limited prospects to fund emergency situations paint a picture of very fragile finances for those who are helped by REI in Indonesia.

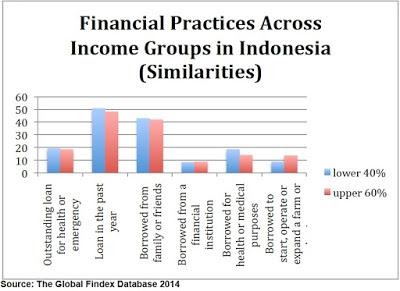

In contrast, Figure 2 below presents similarities between the two income groups, leading some to conclude that perhaps Indonesia has achieved a degree of equality between low- and high-income groups. After all, the incidence of borrowing among the poor is quite similar to the incidence of borrowing among the high income families. On the surface it appears that capital flows just as well toward low-income clients as to high-income clients.

However, it’s important to note that a low incidence of saving for the low-income population, which was observed in Figure 1, should imply a high incidence of borrowing. After all, the households who have no surplus cash reserves are the ones who need to borrow when they meet unexpected financial problems. The financial vulnerability of the low-income group makes borrowing more likely compared to the high-income group. The fact that a higher incidence of borrowing does not appear in Figure 2 provides evidence of a capital market failure.

In order to accomplish the aim of REI – building low-income individuals to build a community – finances must be addressed. But rather than loan money to the low-income segment, REI in Indonesia has implemented a strategy involving income-generation, which strengthens household finances before emergencies arise. Indeed, participating households typically double their annual income during periods of production.

The additional income obtained by the families who participate with REI allows those families to respond to emergencies and increases the likelihood for others that resources will be available when needs arise.

REI in Indonesia recognizes the financial vulnerability of those in the lowest income segments. Believing that building into such people can lift the community, REI has devised a job-creation strategy that can develop those who are financially vulnerable to become productive members of society. We envision employees equipped, families nourished, communities enabled and lives enhanced as they work for Java Bite. Check out the products that result from REI’s efforts.